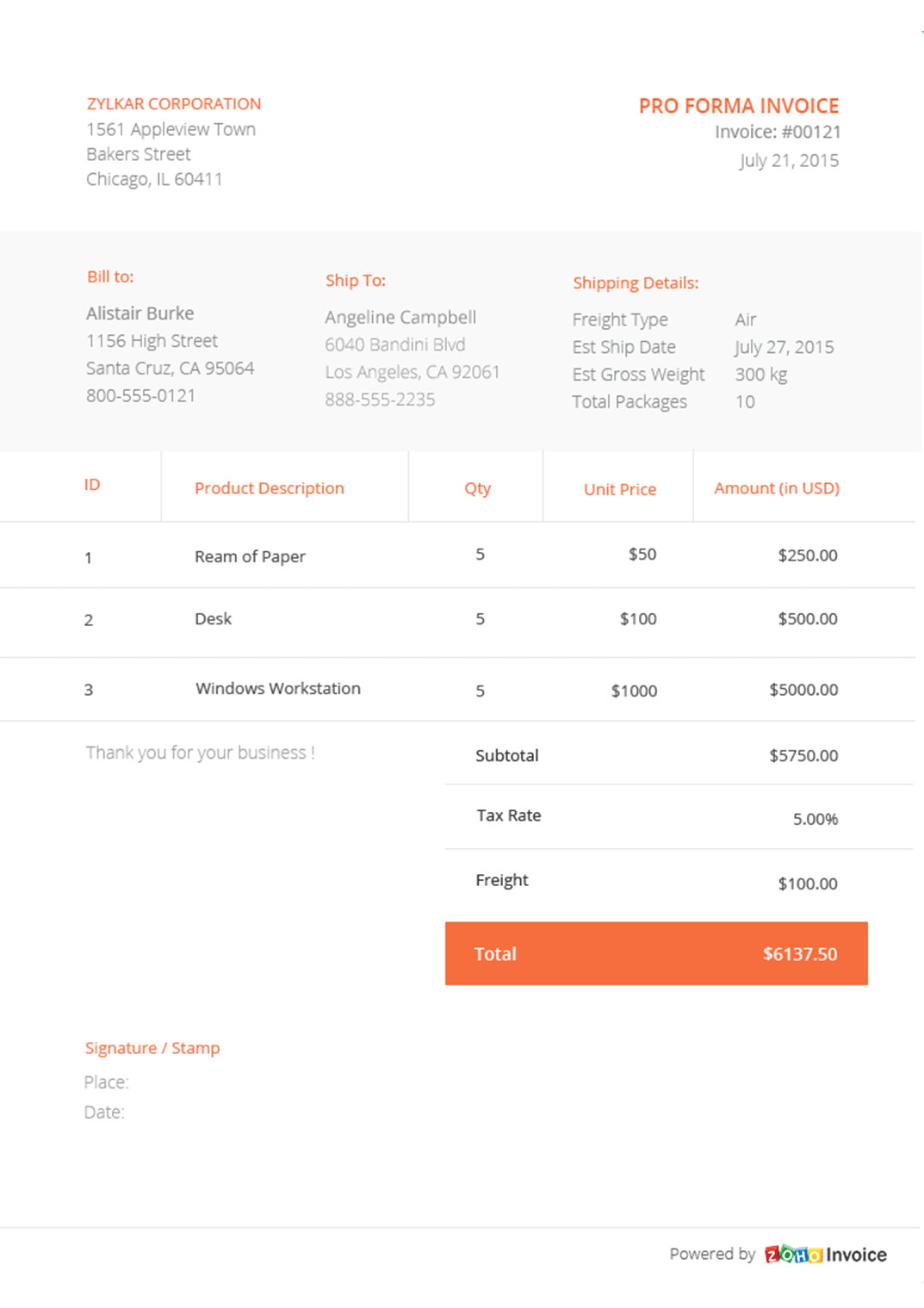

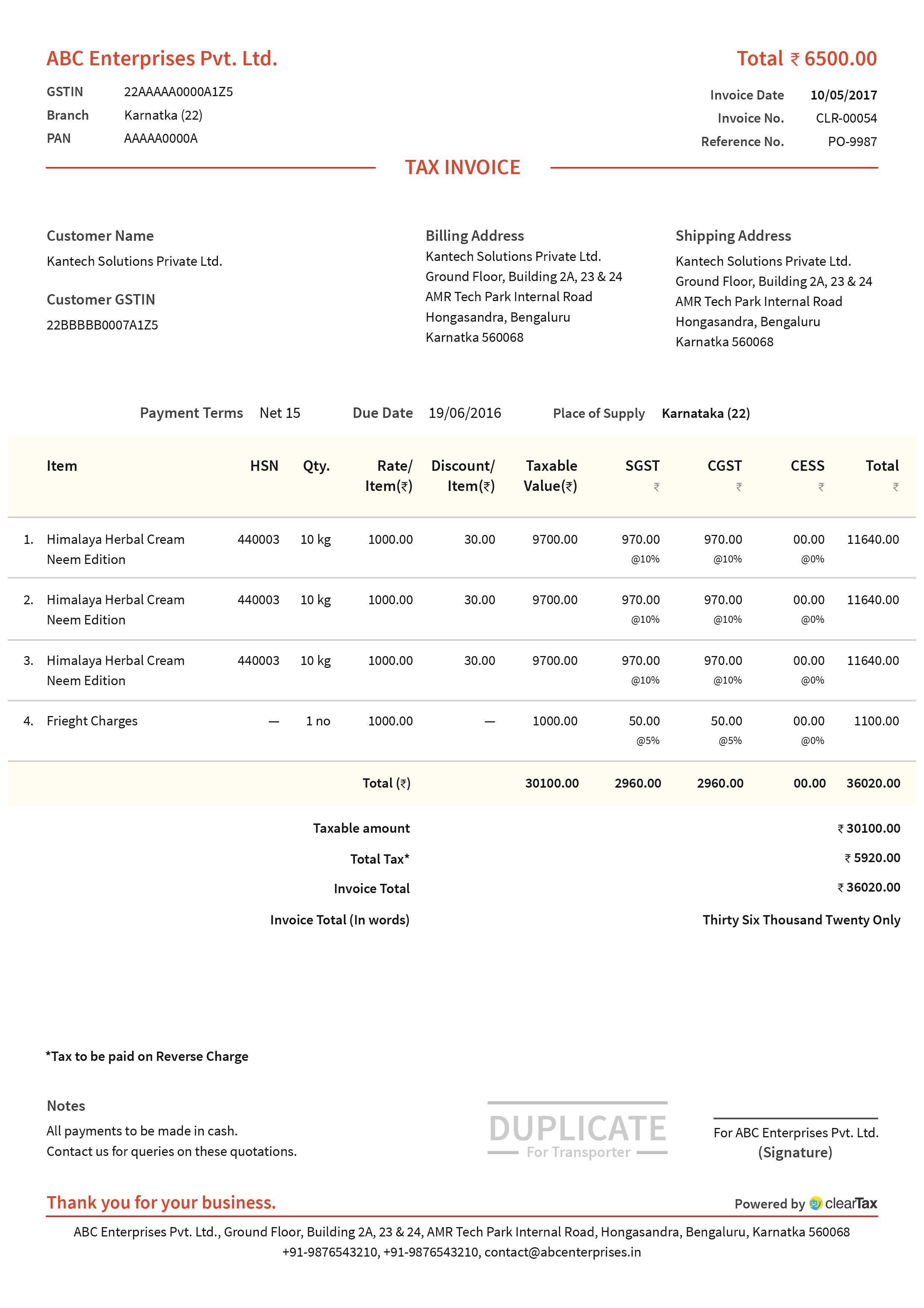

E-invoicing in India is a big move, due to the volume of business transactions undertaken every day, as well as the plethora of different, non-standardized formats used in invoice generation.The GST Council approved the standard of e-invoice in its 37th meeting held on 20th Sept 2019 and the same along with a schema has been published on GST portal.Please note that ‘e-invoice’ in ‘e-invoicing’ doesn’t mean generation of invoice by a Government portal Because of the standard e-invoice schema (INV-01), ‘e-invoicing’ facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format. After following above ‘e-invoicing’ process, the invoice copy containing inter alia, the IRN (with QR Code) issued by the notified supplier to the buyer is commonly referred to as ‘e-invoice’ in GST.

Whats an invoice in gta 5 registration#

As per Rule 48(4) of CGST Rules, notified class of registered persons have to prepare invoice by uploading specified particulars of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).What is meant by e-invoicing? This question is very relevant as its going to transform the system of invoicing in GST.If Aggregate Turnover in any preceding F.Y from 2017-18 onwards exceeds Now again CBIC has issued this latest gst notification 10/2023 Central Tax to amend notification no 13/2020 Central Tax. Means at present e-invoice is applicable in gst to entities having aggregate turnover exceeding Rs 10 cr w.e.f. Earlier this limit was Rs 20 cr, but it was reduced from 20 cr to 5 cr w.e.f.

Notification 13/2020 dated is for applicability of e-invoice.Īs per this notification at present e-invoice is applicable to entities having aggregate turnover exceeding Rs 10 cr. GST e invoice latest notification 10/2023 Central Tax dated has been issued.

Status for Enablement of GSTIN on e-invoice portal.Examples for Applicability of e-invoice.What are the supplies covered for e-invoicing?.

0 kommentar(er)

0 kommentar(er)